We provide Credit Score online (apkid: com.creditscore.scorecheck) in order to run this application in our online Android emulator.

Description:

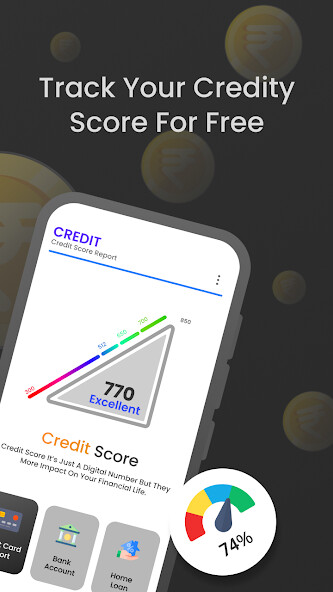

Run this app named Credit Score using MyAndroid.

You can do it using our Android online emulator.

FAQ

1.

What is a credit score?

A credit score showcases a consumer's borrowing power or creditworthiness.

The score can be between 300 and 900 depending on your credit history-- total debt, types of credit, and repayment history.

It allows banks to evaluate a borrower's eligibility to repay a loan and credit card fees.

A higher score increases a prospect's chance of getting a loan with less interest.

Lenders look for your payment history, amounts owed, length of credit history and mix.

There are four major bureaus in India:

a.

TransUnion CIBIL

b.

Equifax

c.

Experian

d.

CRIF High Mark

All bureaus have their algorithm to calculate the credit scores of individuals or businesses.

The Credit Score app provides you with the CRIF credit score the same way you check your credit score for free.

It then helps you find gaps in your report and helps you fix them.

2.

What are the different credit scoring ranges?

A credit score helps lenders or financial institutions analyse the risk of lending money to a prospect.

In India, the score ranges from 300 to 900.

a.

Great: 750 to 900

b.

Good: 650 to 749

c.

Average: 550 to 648

d.

Bad: Below 549

3.

What is a good credit score in India?

In India, 900 is the maximum score set by credit bureaus.

Any score above 700 is good.

A bad score will affect your chances of getting a loan.

Hence, it is necessary to clear your EMIs or monthly instalments and credit card bills on time.

4.

Why is a good credit score important?

Here are some of the benefits:

a.

Faster loan approvals

b.

Increases your chances of getting a credit card

c.

Low-interest rates on loans

d.

More negotiating power

Any missed payments and high credit utilisation will impact your credit score.

5.

How to boost your credit score

The credit score depends on the number of hard enquiries, account mix, credit utilisation, and payment history.

Consistency with your payments over time can help improve and build your credit score.

6.

Does a bad credit score affect employment opportunities?

Some organisations might be interested to know their candidate's financial health.

7.

How much does it cost to get your credit score?

With Credit Score App free credit checker, users can get their score for free.

8.

How often is the credit score updated?

On average, credit institutions typically submit their report within 30 to 45 days.

Sometimes it takes longer to get updated.

9.

Is Credit Score a loan app?

No.

Credit Score App is a free credit score checker app that helps you track your credit score and knowing your numbers will help you fast-forward your loan or credit card application.

10.

Where to check my credit score without hurting it?

1.

What is a credit score?

A credit score showcases a consumer's borrowing power or creditworthiness.

The score can be between 300 and 900 depending on your credit history-- total debt, types of credit, and repayment history.

It allows banks to evaluate a borrower's eligibility to repay a loan and credit card fees.

A higher score increases a prospect's chance of getting a loan with less interest.

Lenders look for your payment history, amounts owed, length of credit history and mix.

There are four major bureaus in India:

a.

TransUnion CIBIL

b.

Equifax

c.

Experian

d.

CRIF High Mark

All bureaus have their algorithm to calculate the credit scores of individuals or businesses.

The Credit Score app provides you with the CRIF credit score the same way you check your credit score for free.

It then helps you find gaps in your report and helps you fix them.

2.

What are the different credit scoring ranges?

A credit score helps lenders or financial institutions analyse the risk of lending money to a prospect.

In India, the score ranges from 300 to 900.

a.

Great: 750 to 900

b.

Good: 650 to 749

c.

Average: 550 to 648

d.

Bad: Below 549

3.

What is a good credit score in India?

In India, 900 is the maximum score set by credit bureaus.

Any score above 700 is good.

A bad score will affect your chances of getting a loan.

Hence, it is necessary to clear your EMIs or monthly instalments and credit card bills on time.

4.

Why is a good credit score important?

Here are some of the benefits:

a.

Faster loan approvals

b.

Increases your chances of getting a credit card

c.

Low-interest rates on loans

d.

More negotiating power

Any missed payments and high credit utilisation will impact your credit score.

5.

How to boost your credit score

The credit score depends on the number of hard enquiries, account mix, credit utilisation, and payment history.

Consistency with your payments over time can help improve and build your credit score.

6.

Does a bad credit score affect employment opportunities?

Some organisations might be interested to know their candidate's financial health.

7.

How much does it cost to get your credit score?

With Credit Score App free credit checker, users can get their score for free.

8.

How often is the credit score updated?

On average, credit institutions typically submit their report within 30 to 45 days.

Sometimes it takes longer to get updated.

9.

Is Credit Score a loan app?

No.

Credit Score App is a free credit score checker app that helps you track your credit score and knowing your numbers will help you fast-forward your loan or credit card application.

10.

Where to check my credit score without hurting it?

MyAndroid is not a downloader online for Credit Score. It only allows to test online Credit Score with apkid com.creditscore.scorecheck. MyAndroid provides the official Google Play Store to run Credit Score online.

©2024. MyAndroid. All Rights Reserved.

By OffiDocs Group OU – Registry code: 1609791 -VAT number: EE102345621.