We provide Hurdlr Mileage, Expenses & Tax online (apkid: apple.hurdlr.com) in order to run this application in our online Android emulator.

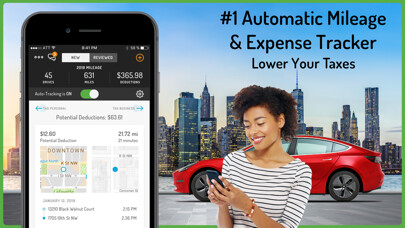

Description:

iPhone app Hurdlr Mileage, Expenses & Tax download it using MyAndroid.

Are you self-employed, an independent contractor or agent? Do you freelance, have a gig, or drive for Uber or Lyft? Hurdlrs business expenses and mileage tracker saves you thousands of dollars in IRS tax deductions.

Plus, easily capture receipts and create expense reports.

Hurdlr connects with thousands of leading banks as well as Uber, FreshBooks, Square, Stripe and Paypal to import your income and expenses automatically for easy income tax calculations.

Youre one step away from throwing away your shoebox of receipts and mileage logs.

Hurdlrs free version offers more than mileage-only alternative apps like MileIQ, including expense, income tax, and semi-automatic mileage tracking.

Our premium version has more robust automation features and is half the price of alternative apps like QuickBooks Self-Employed.

Hurdlr also has a detailed business tax tracker for 2020 quarterly tax accounting.

HURDLR IS PERFECT FOR 1099:

Independent Contractors

Uber & Lyft Drivers

Freelancers

Small Business Owners

Self-Employed Entrepreneurs

Postmates Couriers

Airbnb Hosts

Real Estate Agents

AUTOMATIC MILEAGE TRACKER

Hurdlrs IRS mileage tracking helps 1099s claim maximum tax deductions.

Let Hurdlr track mileage for work, and deduct 57.5 cents for every mile you drive.

Perfect for Uber drivers, Lyft drivers, and other mobile independent contractors.

AUTO-TRACK EXPENSES & IDENTIFY TAX DEDUCTIONS

Connect with over 9,500 banks to auto-track business expenses and identify valuable 1099 tax deductions for independent contractors and small business owners.

Export detailed expense reports with receipts and send them to any email address or to your tax preparer.

SELF-EMPLOYED TAX ACCOUNTING

See your complete state, federal, and self employed business tax calculator breakdown.

Hurdlr provides real-time year end and quarterly tax estimates for independent contractors at the tap of a button.

Watch as your business expenses and IRS mileage tax deductions lower your 1099 taxes saving you thousands of dollars.

INCOME REPORT

Hurdlr sends you a real-time notification anytime you get paid, so youll always know how much money youre making.

OPTIMIZED FOR LOW BATTERY USAGE

Because youre on the road a lot, weve designed Hurdlr to work without draining your battery, even with heavy usage.

BUILT BY ENTREPRENEURS LIKE YOU

Our team of experienced entrepreneurs worked closely with users like you to build the ideal business expense, income, tax, and mileage tracker, so you can focus on doing the work you love.

CONTACT US

We strive to provide the best customer support, answering all of your questions 1-on-1.

Talk to us live, directly from within Hurdlr.

HURDLR PREMIUM

$9.99 a month or $99.99 a year (Save 16%).

Premium Features:

Auto-Mileage Tracking

Auto-Expense Tracking

Auto-Income Tracking

Real-Time Tax Calculations

Speed Tagging

Work Hours

BONUS: Hurdlr Premium can be deducted as a business expense when you file taxes.

Note: Monthly subscriptions renew each month, and annual subscriptions renew each year, unless auto-renew is turned off at least 24 hours before the end of the current subscription period.

Your iTunes account will be charged within 24 hours prior to the end of the current period.

You can turn off auto-renew at any time from your iTunes account settings.

Any unused portion of a free trial will be forfeited if you purchase a subscription before the trial expires.

MORE INFORMATION

Learn about our privacy policy at https: //hurdlr.com/privacy

Understand our terms of use at https: //hurdlr.com/terms,

MyAndroid is not a downloader online for Hurdlr Mileage, Expenses & Tax. It only allows to test online Hurdlr Mileage, Expenses & Tax with apkid apple.hurdlr.com. MyAndroid provides the official Google Play Store to run Hurdlr Mileage, Expenses & Tax online.

©2024. MyAndroid. All Rights Reserved.

By OffiDocs Group OU – Registry code: 1609791 -VAT number: EE102345621.